Strategic Plan Goals

Facilities

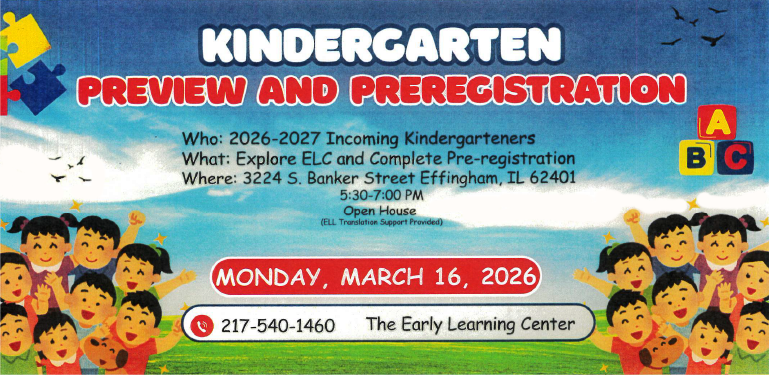

· Plan and centrally locate Pre-K through 5th grade facilities

· Make all Pre-K through 12 facilities state of the art learning centers

Finance

· Ensure adequate financial resources are in place to achieve the mission, vision and core values of the district

· Allocate finances for competitive compensation to attract and retain quality administrators, teachers and staff

Safety

· Ensure a safe and secure physical learning environment for all students and staff

· Implement a process/system that provides social and emotional support available to both students and staff

Communication

· Implement a Unit 40 strategic marketing plan which includes a cohesive rebrand and highlights self-promotion

· Build a comprehensive and streamlined plan for internal and external communications

Achievement/Curriculum

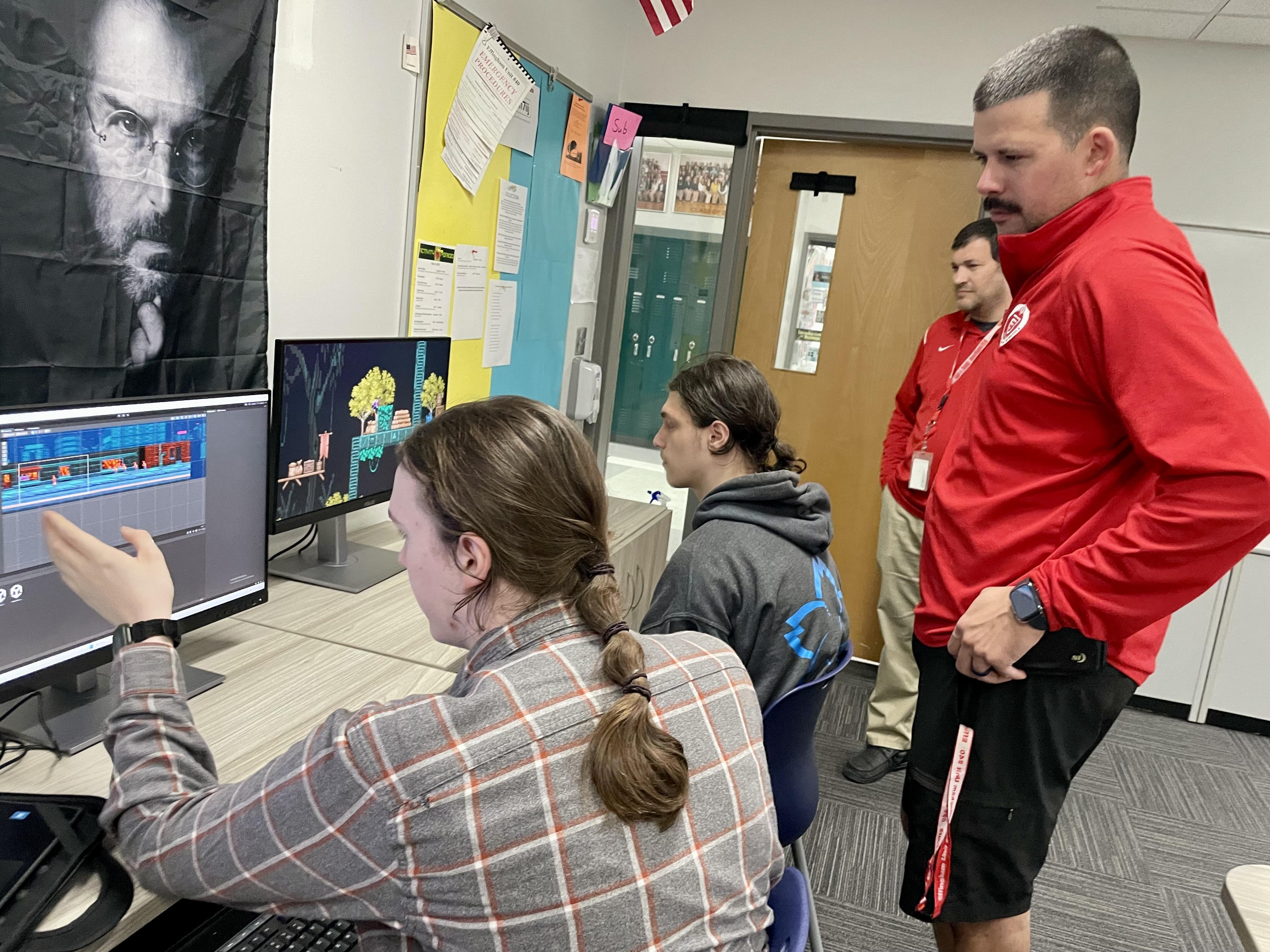

· Provide exploration opportunities from start to finish that allows for student choice and control

· Ensure challenging curriculum to open doors for all students

Technology

· To continually integrate the most current technology in all aspects of learning while constantly evaluating

staffing needs

· The opportunity to have hands-on specialized technology